A statistics course

committed to honest data analysis,

focused on mastery of best-practice models,

and obsessed with the dynamics of financial markets

Course Blog

Archive: Course Blog for Fall 2006

This is the blog for a passed year and it has only reluctantly been saved from self-distruction because some students ask that it be preserved. If you are looking for this year's stuff, you need to go to the current 434 Home Page. Like any one page blog, you'll need to read this one from the bottom up if you want to experience the blog in chronological order.

Artificial Intelligence: Summer News Item (May 2007)

Posted 15th May 2007

Michael Kearns got some great press on Bloomberg for the work that he is doing for Lehman on the use of AI in trading platforms. The analog that you might want to keep in mind is the success of the Big Blue program versus Kasparov. The breakthrough came when they "let computers be computers" and let go of trying to copy human heuristics. Most trading AI still seems to be using the old human heuristic paradigm, but that is not because they are not aware of the Big Blue analogy. It just that it is hard to replicate the precision of the decision tree, or to give analyses of the "final position."

A Flawed Time Series Analysis at SeekingAlpha?

Posted 3th January 2007

This is just a little after the course refresher note. I was just doing my web due diligence and I saw a piece at SeekingAlpha that offered some quantitative analysis of the bonds versus stocks for the last months of 2006. The analysis is comically flawed. Have fun with it, and rest assured that no (not even one!) Stat 434 student could make such fundamental, logical errors. Were not talking fancy details here, just stone cold stupidity (mixed with a nice dose of ignorance).

Where We Go From Here

Posted 17th December 2006

I will not be making regular up-dates to this web page until we get closer to the spring time selection period for fall courses. Still, I won't erase things either, so if you are thinking about taking Stat 434 in the Fall of 2007, what you find here should give you an honest impression of what the course is all about. If you are shopping please do read the little piece I have written about expected changes and course expectations.

In the Spring, when I find some free time, I will restructure the page so that the material for 2006 can be read chronologically, rather than in blog-order. I will also archive (or delete) much of the 2006 course material.

SOLAR FLARE

Posted 14th December 2006

Yesterday, December 13 there was a massive X-3 solar flare. This is particularly unusual since the Sun is currently at a low point in its 11-year cycle of solar activity ---- a cycle that was diagnosed in one of the earliest applications of the AR(2) model. One could say that the cycle was discovered via the AR(2), except that it is also pretty darn obvious from the time series plot.

I haven't done the final count, but it looks like all the final papers got handed in. Congratulations to all! I had a great time teaching the class, and I hope that you both enjoyed it and learned a bit about financial time series.

I'll have the grades done by Tuesday, December 19. If you want to pick up your paper at that time, I will be in the office in the afternoon (2pm to 5pm). Otherwise, I can mail you your paper (one per team), or you can pick it up in the Spring. We can also make other arrangements, but the papers will not be left in the hall. Public disposition of papers is a violation of University policy. It is also messy, and it feeds the mice. Yes, we have mice in Huntsman Hall, and there are even a few baited traps in obscure corners of the suite.

Project DUE TIME: Thursday Dec 14 at 11am

Posted 11th December 2006

I've received a few direct and indirect questions about the possibility of handing in the project 'a little later.'

Don't even dream about it.

The due date was set on the first day of class: It's exactly as in the university exam schedule. You can hand in your project at any time between 10am and 11am. I will be waiting in my office. If you want to hand it in earlier, this is possible, but you should contact me for arrangements.

Whatever you've got, you've got. Just deliver it. That is the way business works.

A project that is late for whatever reason will be penalized at at least the rate of one letter grade per day.

Office Hours During Reading Week

Posted 10th December 2006

I will be around my office on Monday December 11 and on Wednesday December 13 in the afternoon. The best time to chat would be between 2pm and 4pm. If you have coding questions, you will probably get better help from Kevin, who will be available by e-mail.

Pre-proposal Jitters...

Posted 3nd December 2006

Some folks are getting jitters. Keep in mind that your proposal is just a proposal. The purpose of this part of the process is to "force" you to make your ideas concrete, and to give you the chance to see lots of examples of "stuff that should work" and "stuff that seems doomed."

It is expected that almost everybody will change their plans in some way or another based on what they see and hear from their colleagues on Monday and Wednesday. This is the whole purpose of this (pretty expensive) exercise.

The plan was set long, long ago for these last two days. It is crunch time, and if you are interested in the business world, then you know that lots of stuff has to be done when is is due --- come rain or shine.

There are no incompletes and no make-up exams on Wall Street.

Keep in mind you proposal is just a proposal. It must be handed in on time, but it can --- and often OFTEN SHOULD --- be amended.

What matters is the final project. The proposal presentation process is just a step to help you make your final project as good as it can be. Please read the project design advice posted yesterday.

Project Design Advice

Posted 2nd December 2006

The weekend is starting to look like crunch time for many people. I am getting some interesting questions. Here are some thoughts that should help everyone.

How about using PE ratios? This is a good question since it comes down to pure logic about your data. How does a PE ratio change? It changes a little bit every day with P, and then four times a year it changes quite a bit because earnings have been announced. Note, that we find out about Q2 earnings only well into Q3---so we have lags to worry about. You can use PE ratios, but you have to take these practical issues into consideration. In particular, except for four days a year the PE ratio behaves just like scaled price. Would you want to used scaled price in your analysis? Possibly, but it would be atypical --- and hazardous.

This is all pure logic, and such logical tests should be part of your design process. If you do not make the logical steps like those described above, you can end up talking nonsense.

How about using some macro-economic data --- inflation rate, unemployment rate, growth rate, etc? Again, this is a matter of pure logic. These numbers are not daily numbers, they are at best monthly--- more commonly quarterly, and they are never contemporaneous. They are always reported with lags, and they are very often revised months later. You can use these variables if you take these issues into consideration. In particular, you'll need to think through the logic of the differing time scales.

The issue of in-sample versus out-of-sample. Everyone should aim for an analysis that has an out-of-sample test of validity if at all possible. As you are designing your project you need to ask yourself how you will do this in a clear and honest way. For a few projects, this may not be possible and in a few it may not be relevant (say in a simulation project). Still, if an out-of-sample test is not part of your plan, you are probably on thin ice.

Logic of time scales. One can use daily data, weekly data, monthly data, or even quarterly data --- but you need to keep the logic of the time scale clearly in mind. We often used daily data just because it was easy, but you may have a better chance of "finding significance" if you use weekly data. If you use quarterly data, you really will need to ask yourself if you think that it is logically reasonable to assume stationarity.

Your project proposal should be quite concrete. Read the specifications. Check all the boxes. Don't grab at straws. Imagine yourself making a proposal to a boss. Keep it practical; keep it logical Keep your expectations rationally calibrated.

Final Report Presentation (worry about this after the proposals)

Don't forget about basic EDA tools like box plots. These can help you put a lot of information into an easily understood picture. You can use tables, and most reports will need to have a fair number of tables, but whenever possible you should also look for a graphic presentation of your results. In any table you should also point out the most significant features --- but be very selective about what you say. There is no reason to give a repetitive verbal description of every cell in every table in your report.

Proposal Presentation Order --- and Details

Posted 29th November 2006

Everyone should check the ordered list for the proposal presentations. If you have number 10 or less you should be prepared to make your presentation on Monday. Each presentation should be kept to 10 minutes, have no more than 4 PPT slides, and be accompanied with a brief written piece to be handed in.

We have the classroom for an extra 30 minutes on Monday. I hope that many of you can stay, but if you have to leave at 2:50, that's OK. Everyone who has not presented on Monday must present on Wednesday.

Your presentation should be accessible via the web. You should make the transition from presentation to presentation as smooth as possible. It is tempting to celebrate a bit when finishing, but we really need to save the minutes for the other students.

Your attendance on these days is very important. Everyone's project is enhanced by seeing all of the presentations. Plus, your buddies expect you to be there.

Encouragement from Wired

Posted 25th November 2006

Wired Magazine did a piece on the Prediction Company. It is characteristically thin on details, but it does confirm that there is a market out there if you have a story that you can present with a straight face. It also shows what "journalists" find interesting --- and credible.

Office Hours --- Wednesday Nov 22

Posted 20th November 2006

I WILL have office hours on Wednesday, just not at the usual time. For this Wednesday only (since there is no Statistics Seminar), I can meet with students from 3Pm until 4:30. This could be a great time to discuss your project ideas.

The End Game --- Project Proposals, Projects, and More

Posted 20th November 2006

There are only six classes left, and one of these is the Wednesday afternoon before Thanksgiving which is not known for a big turnout, even with the juggling lesson.

We also have project proposals presentations, which will take the last two days of the term (Dec 4 and 6).

In three days up for grabs, we want to say a word or two about "technical analysis" as the term has been used traditionally , and one a higher note we want to cover the Nobel-winning idea of co-integration, and provide as much coaching as possible about the design of the projects. Some of the things to discuss include: (1) how to compare strategies that have different risks, (2) how to deal with multiple comparisons among strategies, (3) how to use "training samples" and "out-of-sample" tests.

We have seen pieces of all of these issues before, but now we have to start putting the package together. We are done with the homeworks, and your 434 skill set is close to complete. Now is the time when your own initiative and imagination has room to romp.

It's time to crank up the class participation. Get those questions out there. You'll be helping everyone.

Incidentally, even though I in class I avoid politics like the plague, I though you might like to take a look at Thanksgiving in Iraq. It's not political, and it is touchingly human in an ordinary-Joe sort of way. It's also a little goofy, in a way that reminded me how different my world is from many.

Trivia question: What contribution did Harry Truman make to the Thanksgiving holiday? I do wish that he had followed his own talents and given us a Poker Holiday.

Some Items for Context

Posted 15th November 2006

There are several brief pages that provide discussion of some topics that are of relevance to our class. Some of these are purely for "cultural background," but some will be coved in a fair amount of detail.

- Efficient Markets

- Endowments and their new Portfolio Choices

- GARCH and the Zoo

- Model Selection

- Performance Measures

- Portfolio Construction

Black-Scholes and Option Pricing

Posted 8th November 2006

Bloomberg's quant corner has a friendly article on the Black-Scholes formula. It does not go into the "greeks" or the delta hedge, but it is still informative.

MBA Student Authors Book on Trend Trading

Posted 7th November 2006

Here's a little blurb picked up from Knowledge@Wharton: "MBA student Kedrick Brown, WG'08, recently authored a book titled Trend Trading: Timing Market Tides, which describes how to trade equity trends with sound planning and money management discipline."

If you get lucky, maybe you can turn your final project into a book proposal? Or, if you need more motivation, you might recall that Federal Express was started by a Princeton undergraduate whose senior thesis became his business plan. It was the same story with Jack Bogle and Vanguard --- senior thesis to billion dollar business.

Advance Planning

Posted 5th November 2006

On Monday we'll have HW8 (GARCH) and next Monday we have HW9 (Rolling Regressions). November 20 is the Monday before Thanksgiving, so we will have no HW, but we will go over the plan for the final project. The project is actually a three step affair. There will be a a brief written project proposal, a brief presentation of the proposal, and then the final project --- which might run on the order of twenty pages. The project proposal presentations will be in the last week of class (December 4 and 6). The final projects. Will be due at 10:30 on Thursday December 14.

Weekend Reading

Posted 4th November 2006

Dean Foster, who is currently visiting the Center for the Study of Rationality, passes along an interesting article about risks, perceived and real. The discussion is qualitative, but it still contributes to our conversation. Can you think of any trading strategies that would take advantage of the kinds of human biases that are covered in this article?

Homework 7 Modified (as Mentioned in Class) Also Some Tips about "Risk Free Rates," Bonferroni-Holms, etc.

Posted 3rd November 2006

This is just a reminder that I modified Homework 7 slightly since it was posted. Specifically, the multiple comparison tests should be part of your portfolio analysis, not part of your index exploration. I mentioned this modification in class, but just now changed the posted file.

What interest rate to use?

Oh, you lucky folks who started your homework on Friday afternoon are in for a treat. You can use the series that I got from the Fed and cleaned up.

This is for 4-week Treasuries and what is stated is the yield for that day. You will need to convert this to a one day return. Do not worry about the change in the prices of the T-bills --- just take the returns like they were the returns from a pass book account and do the logical arithmetic. In T-bill world, the year has 360 days --- but don't worry if you have used some other number (such as 365 or even 252).

The Suggestion from the WRDS Help Desk --- It Helps Too!

"Hi, The easiest way to get the daily 'risk free rate' is in our Fama-French Factors located in our web site http://wrds1.wharton.upenn.edu/ds/famafrench/index.shtml Here select, Factors (under daily frequency) http://wrds1.wharton.upenn.edu/ds/famafrench/factors_d.shtml The 'Risk Free Rate' is the one month treasury bill rate."

This is a good suggestion and it may be easier than working with the Fed data linked above. Some people have gone this way and it worked fine for them.

More Interest Rate Resources?

Incidentally, the Federal Reserve has extensive time series of interest rates. Almost any short term rate on the list would be appropriate and would not change the analysis.

A Reminder about the Holms-Bonferroni Procedure:

Suppose you have done 8 tests of the significance of alpha and you now have 8 p-values. Order these from smallest to largest. If 8 times the smallest is still under 5% declare it "significant" and continue, else stop and declare that all of the p-values are in significant. If the first value was significant, look at the second and multiply by 7. If this is less than 5% declare it to be significant and continue, else stop and declare that it and all of the remaining values are insignificant. This is the general process that one can apply to all of the p-values.

Homework 7 Now Available : Your Own Index and CAPM

Posted 30th October 2006

The new homework offers more scope for the kinds of creative energy that were unleashed in HW5. This time you get to create your one index and look at the possibility of forecasting its returns. You also get to do a small scale CAPM test that suggests how you can (gingerly) advise the chief stock-picker of your new firm.

We will have three only two more homeworks after HW7. In HW 8 you will explore ARCH/GARCH models and in HW9 you will explore rolling regressions. There will be no HW assigned on Monday November 20, the Monday of Thanksgiving week, but I will hand out more detailed information about the final project. Project Proposal Presentations will be given November 29 and December 4 and 6. The final project itself will be due at 10:30 AM on December 14.

Incidentally, there was a recent Philadelphia Inquirer article about poker and investing.

Looking Ahead To Thanksgiving

Posted 22th October 2006

Some students have asked about what might be covered on the Wednesday before Thanksgiving. First, there is traditional "treat" for those sturdy souls who do show up: a brief micro-presenation on "juggling and data analysis." Yes, you will learn how to teach yourself how to juggle, and, No, this is not as cheesy as it sounds.

Juggling duty being done, the rest of the class will deal with a topic that is not part of our core curriculum, but which many students find interesting: empirical option pricing---or Black-Scholes in the real world. One of the sources for this discussion is the 2003 essay by David Mackenzie.

Kevin's Office Hours

Posted 19th October 2006

On Friday October 20, Kevin's office hour will be 4:00-5:00. After the Fall Break, his Friday office hours will be 10:30-12. Let me or Kevin know if this change creates a problem for you.

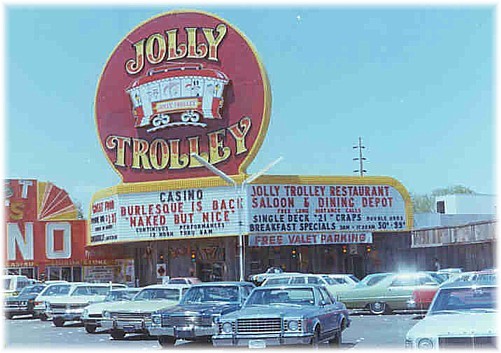

Jolly Trolley, the Keno Knock Out, and More

Posted 16th October 2006

I chased down and pasted it below. It was not the kind of place where a lot of clients were likely to ponder the significance of a huge Chi-squared. Check out those early '70s cars and search Jolly Trolley for more archival material. If you do a Lexis-Nexis (or deeper) search --- let me know what you find.

II believe that Gary is now a full- time bridge player and philanthropist based in Brooklyn and the Hamptons. Joel has made several major contributions to blackjack. In particular, he wrote the first paper on the consequences of nonrandom shuffling. Gary and Joel were both part of early MIT blackjack teams that pre-dated those about whom books and movies have been made.

They also put together a profitable slot machine play in the early days of Atlantic City. This play is the only one I know that had a written business plan and that retained tax council before it went into action. Incidentally, the action was successful, the money was collected and distributed, and the subchapter S corporation was dissolved with no outstanding tax liability.

Monday Econometrics Seminar

Posted 16th October 2006

In Monday's Econometrics Seminar (16 October, 3:30-5, in McNeil 410) Olivier Scalliet will be speaking on "False Discoveries in Mutual Fund Performance: Measuring Luck in Estimated Alphas." This is quite relevant to our course and should be (reasonably) accessible to students. I plan to go, and I hope to see some of you there. Incidentally, this will mean that my Monday office "hour" will just run between 2:50 and 3:25, but you can always get me by e-mail.

HW Questions (and Modified Examples) for Kelly Betting

Posted 12th October 2006

I cleaned up the illustrative code for Kelly betting AR(1). The revision answers one question that was raised by Estellay (about num) but leaves open another raised by Simon (about stderr).

When you do the simulations you will see that they are extremely violent. There is no conventional theory for choosing between with risk/reward trade offs like these, so you are mainly left to your own intuition. In a way, we are looking at a St. Petersburg type situation --- though not quite as bad.

If you want to get more reasonable results cap your bet fractions between 1 and -1. BTW, you should note that we have some bets of negative size. That is, we go short sometimes. Capping the bet sizes would be a very useful variation, and it would also be useful to print out the bet sizes (capped and uncapped) Part of the wildness of the wealth process comes from the fact that we are sometimes using crazy leverage (with zero margin rate).

Finally, if you get really ambitious, you can work out the Kelly rules using margin rates. This is not super-hard, but it is a little messy and it is certainly more than I expect people to do in this exercise.

Fortunes Formula, EMH, and Kelly Bet Sizing

Posted 10th October 2006

The day plan focuses on how one brings the Kelly principle into working contact with the AR(1) model. We'll develop some formulas and also some code. The wisdom of such activity forces us to give some consideration of the eternally present Efficient Market Hypothesis (in three flavors) .

We'll also spend a little time reviewing our own big picture. In particular, how do you know if you "understand" the ARIMA(p,d,q) class of models? Now is the time to get comfortable these basics, because soon we will be putting several more balls up in the air. Ambiguity and uncertainty are going to increase, and it you stay in this business they will never decrease.

When are the FINAL PROJECTS due?

Posted 10th October 2006

The project due date is determined by the University Examination Schedule. Your final projects are due on Tuesday December 19 at HIGH NOON. Naturally, you can hand the project in earlier if you like.

Using Models to Make Bets

Posted 9th October 2006

Today we add a new element to the mix --- using a model to develop a strategy. This is actually a huge topic, but we will carve out a small, instructive, and controversial slice --- The Kelly Criterion for Bet Sizing. This gives us a brief break from the development of ARIMA technology and gives us a chance to use what has been learned in a context that has lots of intuitive content. We also get to do a small amount of mathematics.

Missing a Partner?

Posted 4th October 2006

I gave a pitch in class today about the value of having a partner. If you find yourself working alone now, and you'd like to partner up, please send me a note. I will match people up as best I can. I have one person now who would definitely like to be part of a team. Partnerships are particularly useful during project proposal time and project delivery time.

Books on Reserve

Posted 4th October 2006

A copy of Zivot and Wang and a copy of Krause's Basics of S-Plus are now on reserve at Lippincott Library (2nd Floor West of the Van Pelt Library Building). You definitely need to have your own copy of Zivot and Wang (especially for the project time crunch), but it you find yourself in the middle of campus with out the 20 pound ZW, it may be nice to know that there is a copy not far from the button.

ARIMA --- Features and Fits

Posted 3th October 2006

On Day 8 we went over the key theoretical features of the ARIMA(p,d,q) models, including the issues of stationarity and invertability. Everyone knows all about the phi's, theta's, gamma's, and rho's --- a fair slice of the Greek alphabet. Now on Day 9 we look at the software tools for doing simulations and estimations. We also continue to work our way through a growing list of the big picture issues that both plague and elevate the modeler's life.

Stuck on Ergodic?

Charles Pensig passes along an amusing popular essay about ergodicity. Mathematics is easy to explain, if you know mathematics --- but even brilliant people have found mind numbing difficulty with even the familiar sentence beginning " Let x denote the value of the unknown quantity..."

They ask themselves, "If I don't know it, how can I let something BE it?" Well, we can, it just takes some getting used to.

John von Neumann once said: "We don't understand mathematics, we just get used to it." Well, the notion of "ergodic" is somewhat the same. We can master the definition, but mastery of the real notion just takes lost of "getting used to." Incidentally, the definition of ergodic in Z&W is wrong. Their definition and mine will coincide for Gaussian processes, but since our first brush with real data we know that we can't expect to see too many of those.

ALERT: Data Importing Notice !

Posted 28th September 2006

Some students are reporting that the FILE | IMPORT screen that comes up from their down-loaded student version of S-Plus does not bring up the screen that we considered in class. I have not been able to replicate this problem. Let me know if you run into this problem, and ESPECIALLY let me know if you find a way to work around the problem. I will post your suggestion here and everyone will be in your debt.

Current Status--- Kevin's Report

"The S-Plus we installed on the other computer here in the TA office works fine. I had a student come by with a "non-working" version of S-Plus. We uninstalled the S-Plus, downloaded S-plus from the website and installed S-Plus again. I checked his S-Plus code before uninstalling and it was the same one we gave out. So I don't think the problem is with students using a wrong code. We just finished installing the S-Plus and it works fine now."

"I haven't really figured out why some versions wouldn't work. But I had another student come in and he said he didn't have problems with his S-Plus data import window. So for now, I think the easiest suggestion is to have the students with malfunctioning S-plus software to do a complete uninstall and installation. This should fix the problem."

AR(p) model --- Features and Choices

Posted 26th September 2006

The main part of the plan is to introduce the general AR(p) model. We'll discuss the historical contribution of Yule, his equations, and the ability to pick up periodic behavior, such as one finds in the famous sunspot data. We'll also put together the tools one needs to discuss stationarity, and --- of great practical importance --- the tools for choosing p. We'll also open an important conversation about "parsimony" in models: miracle, credo, or a practical and well-founded heuristic?

Using WRDS, Testing for Normality, Pondering Classical Assumptions

Posted 25th September 2006

We went over the codebox piece on using WRDS. This also covers the importation of data into S-plus. We then pondered the role of assumption in models --- with help from the Black-Scholes model and a consulting story about a customer survey from a bank. We started the discussion of normality testing and fielded some questions about "stationarity" testing. We noted that our formulas for AR(1) means and variances do not depend on the assumption of normality.

In the example of IBM daily returns for 2001-2006, we found that the t-distribution with 5 degrees of freedom yields a respectable qqplot vis-a-vis the observed IBM returns. Normality of returns was trashed--- both by qqnorm plots and by the new normalTest() tool. We discussed HW1 (going back), HW2 (coming in), and went over the newly assigned HW3.

Searching for Dependence, Pondering Stationarity

Posted 19th September 2006

The day plan lays it out: More on the Ljung-Box test and its predecessor the Box-Pierce test. Coverage of material in the codebox. Introduction to the Wold representation in the simplest case. First blush with the Lag Operator --- and its arithmetic. Why the Wold representation is truly cool. The mystical role of stationarity. Oh, and a cultural link to the original Ljung-Box paper --- just for fun. Codebox items for Day 5.

HW1: What to hand in?

Posted 17th September 2006 4pm

I added a line to HW1 to be more precise about what you should hand in. We can expect a little variation in the kinds of reports people chose to make in HW1. As the term progresses, I'll give more coaching about "reporting style."

Stuck on HW1? Is Stat 434 Really Right for You?

Posted 15th September 2006

If you nodded off a time or two last week, and if you are now looking through Zivot and Wang to get a little help with the homework, then you have the opportunity for a modest discovery ---Zivot and Wang will not help you with HW1 . So far, our course and ZW have not bumped into each other--- it will happen soon, but not yet.

This is a good time to take inventory. Does Stat 434 really fit with you background, interests, and expectations? The people who take this course should only be those people who have (1) a taste for data analysis --- and this entails a big slug of programming, (2) the maturity to deal with a course where you can't catch up by "reading the book," (3) the agreement that you really mastered the prerequisites --- not just lived through them, and (4) the personal strength to deal with the agonizing "what's going on here?" ambiguity that accompanies any genuine confrontation with data.

It's not a problem if you decide that Stat 434 is not the course you want to take. This is a special course that works well for a special group of students. It can be a real toothache for students who don't meet the four criteria suggested above.

If you are in anyway uncertain about this class, I implore you to consider alternatives. At a minimum, please email me so we can talk about the possibilities. I am delighted to help you find a course that will really work for you --- it may be Stat 434 but it may be some other course.

Kevin's Office Hour Questions and Your Homework No. 1.

Posted 15th September 2006

Kevin had some questions today from people who needed a refresher on the syntax for writing functions and for-loops. He has posed a brief summary. Additionally, there is the code for computing ONE value of rho hat, which was posted on Wednesday in the CodeBox.

Setting Up For Day 3

Posted 11th September 2006

The day plan bullet points for day three have been posted.

Saturday Morning Post

Posted 9th September 2006

Here is Homework 1 which will be assigned on the 11th and due the 18th. It will only make sense after the Monday class --- but it should ALL make sense after that class

Thursday Note about Finmetrics Software

Posted 7th September 2006

Hopefully you got the S-plus software successfully downloaded. You may have then noticed that the Finmetrics software was not on the Insightful Site. This is a change from last year. What you should do now is go to the Finmetrics Link that Dan Huang has set up. You will need to use the un-zip software on your computer, but essentially everyone will have it. If you don't have it --- well --- it is a good thing to get!

Day One Arrives

Posted 5th September 2006

On Wednesday, there will be three main objectives, beyond going over the logistics of the class. First, there is the big picture, which can only be partially captured by the formal mind map. In class we'll use the interactive FreeMind Software to give a shaped outline of the course. You may enjoy this free, open-source software; it's quite handy for conceptualizing a paper, or reviewing a course.

Second, there is at less a little nibbling at our first model --- AR(1), the simplest auto-regressive model and the simplest alternative to pure random noise. Over the course of the term, we'll develop considerable expertise with this model, but the main purpose the fist exposure is to help you calibrate the level of mathematics we will be using --- not too high, but not too low

Finally, we'll have a real-time introduction to S-plus which is our main software tool. Before next Monday you are expected to have installed S-Plus Finmetrics on you PC and to have given it a test drive. You also need to complete the student questionnaire and bring it to class.

Note: There are many S-Plus tutorials on the web. My advice is not to bother with them. We'll develop the tools that we need as we need them, and there are many S-plus tools that we will never need. Moreover, we will work almost exclusively from the command line, and many of the web tutorials are for lower-level courses that rely on the graphical interface which would only stir in confusion.

Looking Forward to the First Day

Posted 20th AUGUST 2006

As you see, for Fall 2006 there is a new web page design. The course itself will not change too much, but one significant change is that we will immediately start using Zivot and Wang (2nd Edition) so students will only need to buy one textbook. The software that we use will be distributed on-line, and secure access keys will be distributed in class.

e-Handouts

2006 e-Handouts

Engle/Granger Nobel Adv. Info.

Note: This class will only follow part of this plan. I will archive a version that does correspond to what we actually do.

Since there is no class on October 23, no homework will be assigned on October 16. This can give you a chance to conduct a personal mid-course review.

On Day 4 we'll use two pages from the codebox.

Other Links

^ Top |

Steele Home Page |

About This Web Design

Copyright © J. Michael Steele