A statistics course

committed to honest data analysis,

focused on mastery of best-practice models,

and obsessed with the dynamics of financial markets

Course Blog

Hello: The Material Below is from Fall 2012

I am not teaching Financial Time Series this year, but I'll keep the blog up for a while. This term (Fall 2013) Professor Foster is doing his version of Financial Time series. The course is in "blog order"; for "logical order" you need to start reading from the bottom.

Cheese: 92M USD of It

A British Cheese company has contributed cheese to its pension fund.

Teams List and Presentation Schedule

Please check the PRESENTATION SCHEDULE for time of your team's presentation.

Citigroup --- Sales and Trading Event

Divya Krishnan took 434 in the Fall of 2008 (a tough year!) and now he is working in Sales and Trading at Citigroup. He's also organizing a campus event --- check it out:

On November 26th and 27th, Citi’s University of Pennsylvania Alumni will be on campus to discuss careers in Sales & Trading. In addition to holding a Sales and Trading information session/workshop on campus, some of the professionals from the Sales and Trading team will offer their time to meet informally, individually or in very small groups, with students to discuss our Sales & Trading program, as well as to review resumes and discuss interview techniques. Any students interested, please send a resume to Divya Krishnan at divya1.krishnan@citi.com

Onto the Final Turn...

First Deliverable: Monday November 26. A Two Page Description of your Proposal. This is for me to read to be prepared for your Proposal Presentations. Proposal Presentations will be on November 28 and December 2 and December 5. Written project reports will be due December 18 (hard copy and electronic copy).

From the Sunday Round-Up

Tim Harford, “The efficient markets hypothesis is surely false. What is striking is that it is very close to being true. For the Warren Buffetts of the world, “almost true” is not true at all. For the rest of us, beating the market remains an elusive dream.” (Tim Harford)

Day 23: Putting the Pieces Together

For 26 November 2012

Today we will have completed just over two dozen lectures, and this is a very modest number given our goal of dealing honestly with one of the central factors of economic life --- the returns on financial assets.

Our plan for the day is to (1) review the stylized facts that we have verified from our own analyses --- and add a few new twists (2) review our models with a focus on where they add insight and value, and finally (3) look at a few ways these can inform the design of interesting projects. In particular, we'll look at the interesting distinction between univariate, multivariate, and ordered univariate strategies. Variations on these methods can be applied to almost any basic project idea.

I'll also add a word or two about the use of confidence intervals and suggest a new technique --- bootstrapping ---which you can use to get confidence intervals (of a sort) for the return on a trading strategy. The method is not perfect, but it definitely has its charms.

I'll also ring the bell again about the importance of data cleaning, EDA, and presentation with thoughtful tables and graphs.

Generic Advice about Project Design (and Process Comments)

Certainly read the Final Project Spec Sheet. We've already covered the main points in class. The one I would underscore here is that clear thinking is a key to having an excellent report. You want to make clear assertions and you want to make sure that what you assert is backed up by clear, thoughtful, and thorough research. Even a "simple" theme can lead to a very rich report if it is engaged carefully and completely.

This is an excellent time to ask questions about your project ideas and plans --- even though you have already written out your "one pager" pre-proposals.

Sidebar: Promised Link on "Zero Cost" Portfolios

Naturally, they are not zero cost, or why would we hold anything else, since some of these do indeed have positive expected returns. The arithmetic of returns is a little tricky here. I've made one pass, perhaps you can do better. At least this puts some issues on the table.

Sidebar: 130/30 Strategies

It's been kicking around for ages that one might do better to be 30% short and 130% long. You can find a lot about this idea on the web. JAI has a useful empirical piece that is easily accessible.

Sidebar: Colorful View of Style Returns by Year

American Century has a colorful chart that is worth a few minutes of pondering. They call it a periodic table --- which is a bit of a pun, I hope. We can also go to ETFScreen.com for an up-date.

Sidebar: Black Friday Indicator --- Probably Not

Mark Hulbert ran a little regression on the returns for the rest of the year vs the "returns on Black Friday." He used data that went back further than we would ever go and he found what one might guess --- there is no substantial information for the total market that is in the "Black Friday" returns.

Naturally, there are open questions. Suppose we just take 20 years of data --- that actually seems more sensible. Suppose we just look at the retail sector --- that is also more sensible.

The WSJ is full of pieces on seasonal effects this season --- mostly to celebrate that they have not panned out as expected. Still, a hardy sole has taken at look for us at December returns.

Sidebar: Just How Big Is the Equity Premium?

The answer seems to depend on (1) whom you ask and (2) when you ask. This is one take away from a recent survey of 150 texts by Pablo Fernandez. The paper also gives some clarification of what one means by "equity premium" --- there are four reasonable interpretations.

Day 22: Comparing Asset Returns in the Context of Risk

For 21 November 2012

A traditional 434 pre-Thanksgiving day task is to show how learning to juggle with three balls can be a useful metaphor for learning any complex task.

We'll do it again this year --- but it will not be a big chunk of the class. Still, if you are a juggler and you have equipment --- bring it to class on Wednesday.We do want to have a bit of fun on this "extra" day.

One theme is that plain vanilla three ball juggling can be very beautiful --- and magically complex. We won't "cover" it very deeply in class on Wednesday, but even today there is no better way to have four minutes of fun than by watching the Fugly juggler.

Finally, there is our traditional strutting turkey ---- Oh, what he does not know? Sort of reminds me of Bear Stearns's James Cayne going off to his famous bridge tournament secure in the risk management tools in place at Bear Sterns.

Some Possibilities:

(a) A piece from Credit Swiss on the VIX as a signal of market direction. (b) a piece that needs to be up-dated on the World Series of Poker We may do the up-dating in real time! (c) Some discussion of Endowments --- especially at Yale, and (d) a piece on risk aversion that reminds us that most people are really insanely risk averse.

Not a Sidebar --- Back to Business!

The plan for today is to look at the notion of risk adjusted returns from soup to nuts. This is a very interesting topic in financial time series, and it has been developed far less systematically than one might have guessed. We'll consider all of the conventional measures, and add a few variations of our own. We'll also look at what one might learn about risks by consideration of post-mortem analyses of crises and crashes.

There is a some what "dated" resource page on Performance measures. Feel free to take a look, but also take what you see with a pinch of salt.

Not a Sidebar --- Questions about Projects

This is the time for everyone to start discussing the projects --- it's design and execution. I had an email question about the stylistic facts about beta. I'll show how you can do some thinking aloud about the kinds of investigations that beta suggests.

Sidebar: The Risks of Being in Charge of Risk Models

Things do have a way of periodically blowing up, and for some time now banks have found the natural goat -- the guy in charge of the VaR models. It is amusing to look at a story that goes back to 2007.

The moral is the same: if you can avoid being in charge of the risk models --- grab the opportunity. The up-side and the down-side are way out of balance --- Tukey's unobserved risk, the peso problem, and the inevitable earthquakes and asteroids are all on the way. A lot of ships will be sunk --- no way out of that --- but its somehow more tolerable if you are not in charge of making sure the ships stay afloat.

Sidebar: Volatility? What Volatility Are You Talking About?

When I saw the title of the paper " We Don’t Quite Know What We Are Talking About When We Talk About Volatility" by Daniel G. Goldstein and Nassim Taleb, I was quite excited.

At last, I thought, someone is making the point in print that I have made repeatedly in class. Namely, each time we say "volatility" we point to some parameter in some model, but the model and the parameter can differ from utterance to utterance. This is silly of us, but we all do it.

Goldstein and Taleb get a whiff of this, but not the full scent by any means. Still, you should take a look at their paper. It is a quick read.

Sidebar: PDP a Momentum ETF

PDP is a PowerShare ETF launched a few years ago (March 2007). The prospectus is one that would make Jessie James uneasy, but the underlying theory of the asset is interesting. It is a momentum story based on a proprietary momentum index --- which would all seem insane --- except that the proprietary index is published independently of PowerShares. Still, the index provider does not seem hesitant to be a promoter of the ETF. Net-net, this does not look like a healthy development.

Sidebar: Nice EDA --- Two Regions Each with Ten Sectors

If you take the 10 sectors of the SP500 and the 10 sectors of the MSCM EAFE you get 10 pairs of numbers, one for each sector. You can then plot these pairs in two dimensions and then ponder the meaning of the 45 degree line. Lo and Behold! It tells you in which of the two regions the given sector is now doing best.

This gives a very interesting snapshot of current market "stages." Note: Points that are near the line are doing about as well in each region, so not much "weight" should be placed on these points. Still, each one of these points deserves a story.

Note: The graph below is for November 2007 and by March of 2009 one may have wondered if such returns could ever been seen again. Lo and behold, the returns from March 2009 to December 2010 have been marvelous. Future returns may vary -- and surely will.

Make sure you understand the structure of this graph --- it's very interesting. You may have a final project that could take advantage of such a plot. All you need is (a) a collection of assets --- say sector returns that (b) come in two flavors --- say the American flavor and the European Flavor. There are many variations.

For a second variation, I I would love to see the dynamic analog of this graph, even for just one sector. The graph I have in mind would plot (x_t, y_t) where, for example x_t is the period t return on the EAFE energy sector and y_t is the period t return on the US energy sector. We could look at 3 month trailing returns and plot a point for each week. It could be a very informative picture.

Sidebar: Fairness --- and Insane On-Line Broker Pitch

We'll never look at this in class, but you might look at it in some idle moment when you want a good laugh. Its a "tutorial" on an IB tool for an algorithmic purchase of a block of 70K CISCO. Very funny --- well --- maybe not.

Sidebar: Michael Lewis on "The End of Wall Street"

Michael Lewis is famous for his book Liar's Poker which chronicled the goings on at Salomon Brothers during the "Wall Street excesses of the 80's" which were actually pretty tame by contemporary standards.

His current piece is provides a compelling view of the sub-prime development and how if you had a brain and intellectual integrity you could have been on the right side of the trade of the century. It is one of the most riveting pieces of financial journalism that I have read in years.

Sidebar: RiskMetrics on Volatility

The November 2008 research letter from RiskMetrics is worth a look. It's naive in many ways, but it does start some interesting conversations. One should keep in mind that November 2007 was just about the crest of the broader market (mortgage pools and many quantitative strategies started to break a bit earlier). From September 2008 to March 2009 was what looked at the time like a death spiral.

Sidebar: World Series of Poker --- For Whom Does It Make Sense to Play?

The other topic that has served us well on the day before Thanksgiving is a look at the logic of playing in the World Series of Poker. We'll not dig into the details this year, but I may outline what I regard as the crux of the problem. On a pure consumption (i.e. entertainment) model, I'd like to play sometime --- but it is hard to swallow taking a bad bet --- and I could be 100s of times "better" and the bet would still be bad. The theoretical question is if it makes sense for anyone --- and if it does my candidate is Andy Beal. I may have mentioned Andy Beal before in his capacity as a banker, a role that brought him to my ever-evolving quotes page.

Cell Phones

We have a few people in class who are staring down into their phones. This is pretty distracting to me, so I ask you --- please do not check your phones during class.

Day 21: Cointegration and Statistical Arbitrage

For 19 November 2010

Final Project --- The Full Details

The project specification has evolved over many years of experience, so it is hard to imagine the there is any ambiguity that remains to be squeezed out. Still, I do want to go over it to make sure that everyone knows exactly what is expected --- especially at the level of academic integrity.

You must deliver a hard copy to my mailbox in JMHH Suite 400 and you must send an electronic copy to my email. As I mention in the specification, label the electronic copy of your project by your name and mark on the first page if this is "OK to web post" or "Not OK to web post." Both forms of submission are required.

Late reports lose one letter grade per day. This is a huge penalty. Don't even think about it.

You should note on the hard copy and the electronic copy if you are willing to have your report posted on the web for the possible guidance of future 434 students. Without your authorization, your report will not be posted, even if it is the perfect model for a 434 final project report.

Main Business --- Cointegration and its Application

The plan is to develop the theory of co-integrated series and the application of cointegration to statistical arbitrage. There are many of variations on this theme, but we will be particularly attentive to pairs trading. This class of strategies has bought more than one nice house in Connecticut, but its popularity has repeatedly waxed and waned.

The Puzzle that Started Cointegration --- Spurious Regression

We'll begin with one of my favorite simulations. Simulate two independent random walks, store the values in vectors x and y, regress y on x, and WHAM --- you find a highly significant alpha and beta almost every time. Since we know that x can not tell us anything useful about y, we know we have a spurious regression.

Next, we'll look at the way out of the trap --- testing that the residuals are an I(0) process. If the residuals are an I(0) process we are safe (or at least in no more danger than usual). If the residuals fail to be an I(0) process, then we almost certainly have a garbage regression. It is amazing how often you will see people perform such regressions, not knowing that they have fallen into a well known trap.

We'll look at some resources that add further intuition to this process, including the famous "Drunk and Her Dog" story.

Finally we'll look at some ideas from statistical arbitrage including the idea of a synthetic index and methods of pairs trading. I've started a resource page on pairs trading and I will add to it over time.

Sidebar: News Impact in the Classical Sense (Kobe, Katrina, and Crisis)

How much does news move the markets? This is the question that is addressed by what are called event studies, and there is a nice summary of some of these in a popular article by Robert Shiller, who is well-known for his book Irrational Exuberance.

Oddly, the Kobe scenario was one of "bad news travels slowly." The day one reactions were minor, but after ten days the Nikkei 225 had fallen by more than 8%.

One of Shiller's theses is that market impacts are sometimes the result of news cascades; that is, a drumbeat of follow-up news stories can have more financial impact than the initiating event. Since Katrina was post the publication of Schiller's essay, you might see if Katrina fits into his mold. This won't really make a whole project for the final, but it would be a nice investigation to share with the class.

This theory of news cascade also seems relevant to the financial crisis of 2008. Lehman hits the tank, AIG gets massive, bail out, GM hangs by a thread, etc. etc. It's hard for the market to rally if the world keeps presenting a cascade of bad event that are all related and all on a glide path that takes many months to run.

Right now we may have a news cascade going on with respect to Irish banks --- or possibly even Irish sovereign debt --- though that sounds overly pessimistic. Most likely this will play out like the recent concerns about Greece, which the market eventually seemed to ignore. Future returns may vary.

Sidebar: KMP vs KMR

Kinder Morgan is the largest pipeline management organization in the US. Investors can participate in Kinder Morgan either as limited partners in the MLP with symbol KMP or through another vehicle which is a kind of management company that trades under the symbol KMR.

There was a comment at Morningstar that argues that these assets should trade in "lock step." To me it seems interesting to look at the time series properties of the spread on these two assets. You'll want to think about what is really going on with the two, and you will need to keep in mind that it is particularly awkward to short KMR, i.e. it may be practically impossible. Still, if you get amused by MLPs this is where the fight begins. Other items for the soup? Look out for the differences in distributions --- these should make KMP trail KMR if you just look at price levels. News Check: There maybe reorganizational news about KMR/KMP.

If you just look at the two price processes (say via Google Finance) you get something of a pairs trade story, but you have to be very careful about distributions --- which can be whoppers in MLP land.

Sidebar: Details on a Blackrock Bandit Fund

People who have been ripped off are understandably thin skinned, so if you have an uncle who has been conned by some retail Merrill Lynch account representative into buying Black Rock Equity Index Fund CIEBX --- or something similar --- you have to be gentle as you coach your uncle out of the jam.

The objective of the CIEBX fund is "to match the performance of S&P 500 index" and--- provided that they mean the total return of the index holdings rather than just the index price return --- this is a noble goal. Unfortunately, they have a" deferred' front end load of 4.50%, a 0.75% 12b fee and 1.17% expense ratio.

If the "new normal" prevails and a 4% real return becomes your benchmark, then, buying this fund throws away about half of the real return you hope to learn. Buying it is just like giving away half of your future real earnings --- or half of your initial investment.

Buy 100K of this fund, and asymptotically you are guaranteed to get a negligible fraction of what you would get with an investment in an honest SP500 Index Fund such as Fidelity Spartan or Vanguard Admiral. This isn't fancy theory; it's arithmetic. Saving your Uncle from this mistake for just 100K will over time save enough to pay for a big chunk of someone's Wharton education.

Why Do They Do This? It's NUTS!

What I don't understand about Merrill Lynch and Blackrock is why they don't care more about the reputation risk that this kind of larceny at the retail level creates even at the wholesale level. It is transparent that the CIEBX fund is a crass rip-off. Other products are harder to analyze, but, if they are willing to rip you off when you can check exactly how much you have been scammed, then you have expect that they are REALLY ripping you off with their more obscure products.

Do People Learn? Evidently Not

" In 2002, Merrill paid $100 million in fines after regulators found analysts at the firm had recommended stocks they knew to be no good. "(ref)

Still, in every township throughout the land, one can find the friendly well-meaning ML rep, often clueless to his complicity, plugging products that under every possible future scenario will leave his clients with less money than they could have had if they had taken the time to read the prospectus and compare the ML products with the corresponding products from Fidelity or Vanguard.

Small Sidebar: Details on TIPS

There is a piece from GE Asset Advisors that provides a good tutorial on TIPS. It covers the mechanics and discusses both the strategic and tactical uses of TIPS. In a world where there is the possibility of deflation, there are some interesting twists on TIPS. Incidentally, they are a favored asset of David Swensen.

Small Sidebar: The Once Noble CREF is No Longer a Hero

Funds like Black Rock Equity Index Fund CIEBX are rapacious in their greed and exploitation of the credulous, but I am almost as irked by CREF.

In the early days, CREF was a genuine leader in providing investment value. Accordingly, they won a place close to the heart of academia. Sadly, in the last ten years, CREF has exploited that trust, and it now charges fees that are indefensible.

The CREF Equity Index Fund expense ratio is 0.50%, and, while this pales in comparison to the Blackrock fees, it is still a stupid price to pay. You can get the same product from Vanguard or Fidelity for less than a third of this price.

The excess spread --- say 35bp to 43bp--- may not look like much, but at retirement time when you have just 400bp to draw down to live one each year, it is at least 8.75% of your income. That is one hell of a tax!

Sidebar: MLPs

I started a little resource page on MLPs, or Master Limited Partnerships. These form a very interesting asset class with attractive non-standard features, including very fat (and pretty stable) dividends and favorable tax treatment. These benefits spring from the tax law view that an MLP is a "wasting asset," but this theory may not apply to many MLPs --- except as a handy tax law fiction.

Sidebar: Performance in Volatility Regimes

"An out-of-sample back test indicates that switching styles according to market regime can be profitable. Specifically, momentum investing during the low-volatility regime and value investing during the high-volatility regime outperforms consistently and to a degree that appears profitable after accounting for transaction costs." ---according to Mebane Faber in a piece at World Beta which has other assertions that would be interesting to test in the pursuit of cheese.

Sidebar: Wisdom and Forecasting

This chart is from the CXO review Philip Tetlock's Expert Political Judgment: How Good is It? How Can We Know? which describes research on the forecasting abilities of political experts. It seems quite plausible that Tetlock's analysis applies to almost any kind of expert view. Still, in the end all you get is a check list of issues to ponder. Still, this is a starting place.

Day 20: Rolling Statistics and Momentum Strategies

For 14 November 2012

It never pays to ignore what you know, so any forecast, strategy, VaR level, or performance measure needs to be constantly up-dated as new data arrives. There are also nice tools in S-Plus that make this easy. The main tool is aggregateSeries(). This is a very general tool that makes it convenient to do "rolling anything."

Moving Averages --- Simple Minded, but Not Silly

We'll also look at some of the most ancient tools of time series analysis, the exponential weighted average. This is an all-purpose tool that is often used in combination with other, more sophisticated, time series tools. One of the apparent difficulties in the use of moving averages (simple or exponential) is that one has to pick a "window" size. We'll discuss some ideas for dealing with this problem, including" Foster's Trick." This is something that it would be very worthwhile to explore in a final project.

We'll see how it is used in the MACD, which is reported in many graphical packages, including the free on-line chart service BigCharts.com.

One trend line story that seems to have some non-idiot following is the slope of the 16 or 21 day simple moving average. Again, as a project, you could contemplate testing this. Just thinking of the simplest things first, how about a simple ordered univariate strategy based on this theme?

MACD and Other Price Level Favorites

MACD is goofy in some ways but it has fascinated me for a long time, because it so often looks like "it works." Unfortunately, formal tests with individual equities mostly come back with the verdict: "No extra cheese."

I keep looking for the context where MACD really does pay the rent. My sense is that it has a good chance of working well in currencies, and in style spreads --- say small cap value vs small cap growth. It might also be useful in making guesses about sector rotation. Exploration of one or more of these ideas might make a good project.

Momentum Strategies

Finally, we will look at a resource page on momentum strategies. It has a CitiGroup FX Advisors presentation, and summaries for a few leading academic papers on momentum. The CItiGroup piece is pretty lame by the standards of 434, but it is worth a brief look. If nothing else, it suggests that at least some of the competition is not to be feared.

Sector-link: XLY etc...

Sidebar: Tops and Bottoms Identified by Sector Leaders?

A random web wag suggests that at the market tops the leading sector is consumer staples (say as reflected in XLP) and at market bottoms the leading sector is consumer discretionary (say as reflected in XLY). Naturally, this case is built on recent experience, and it does make modest sense. Is it something you'd like to bet on? I can't decide, but it is something that I'll keep in mind.

In the recovery from the 2009 March bottom, the consumer discretionary stocks certainly did well, but it is a matter of checking to see if they out performed technology. Of course, with AAPL you had it both ways, and that has been a marvelous holding so far this year.

One of the things that I find interesting in this analysis is the use of the XLY/XLP ratio. There are lots of other contexts were such an idea my be just what one needs to stir the "missing non-linearity" it to the model. This ratio was particularly jammed around in 2009 because of the wild swings in oil price.

There is a related theory that says that of all the goodies out there that might be counted on for reliable trending --- retail is the king. If you are looking for leading indicators, the retail index RLX may be a good shot.

Sidebar: Yet Another Black Rock Insane Bandit Fund

The Black Rock Fund Equity Dividend Fund (class A) MDDVX , has a front end charge of 5.25% and a turnover ratio of 2%. If you like this asset, just check the SEC filling, get the holdings, and voi-la 98% replication. This is a dominated asset with 750M under management. They should be ashamed of themselves. Oh, by the way, they have 100bp expense ratio, and --- a Morningstar rating of 4 stars --- which seems --- well, perhaps not right.

What a bizarre situation! Well, small turn over may be virtue in some people's view, but why should anyone pay an annual 100bp for the experience?

Sidebar: Markets and Mindshare

The size of the world's bond market (90T?) and world's equity market (65T?) are almost comparable in a "Fermi sense." Historically, returns on bonds equities have clobbered returns on bonds. Moreover, bonds are hardly risk free. For example, the bonds of the Weimar Republic became worthless, but the stocks did not. On a less dramatic scale, you can have a very rocky road with even a 30 year US Treasury --- a 1% rise in interest rates can cost you perhaps 25%, depending on the initial interest rate. So, why are there so many people, businesses, and governments who are happy to own bonds? How does this fit with our "counterparty theory" of strategic investing.

Sidebar: Stylistic Features of SP500 Returns

Wilhelmsson (2006) also deserves some class time. One nice feature of the paper is a break-down 1995-2000 and 2000-2005 of the fundamental features of the SP500 returns. These are very useful for calibration of one's intuition about returns --- and hence for "Fermi" calculations. This is his Table 3, and it is not his main message, of course. The main message is that it pays to deal with kurtosis (fat tails), but may not pay to deal with skewness (asymmetry about zero). One of the take-aways is that GARCH(1,1) driven by shocks that have the t-distribution is the best of breed given method of evaluation. We may not buy that method, but the conclusion may still hold up for us.

Sidebar: Be Short Vol and Expect Sad Days

Straddles, Nick Leeson, and the collapse of Barrings Bank

Sidebar: The "New ETF Report"

There is a big conversation about a Kaufman report on the market impact of ETFs. The full story is far from known, but the report does put many interesting issues on the table. As always, I am curious about the cracks. If the report becomes convent wisdom, then where do we find the cheese?

In general I have a hard time believing that ETFs have a market impact. The exceptions are the commodity related ETFs like GLD. This made gold much easier for individuals and institutions to hold. I is possible that the creation of this ETF had an impact. Similarly, the creation of ETFs for MLP or for convertible bonds my have had an impact; these are thin markets and when new customers can be created for the underlying, one may have big changes.

Sidebar: Financial (vs Economic) Bloggers

It is easy for an academic to endorse various economic bloggers. They are "members of the tribe" and even if tribe members disagree from time to time --- all is forgiven between brothers. It is a little different with "financial bloggers," by whom we mean those rough hewn folks that have the gall to mention individual stocks. Mostly these folks are beyond the academic pale.

Such academic timidity has its benefits. One of the favorite taunts on the fourth floor of JMHH is "What part of asymmetric loss function does he not understand?"

So, with some temerity, I suggest you take a look at recent column at the Reformed Broker blog. I find many pieces there to be informative, and I was especially impressed by the brave piece about TheStreet.com.

In general, if you want a quick view of what may be happening in the world of financial bogs, you might take a look at Abnormal Returns. it is not as good as it was, but it is still useful.

Day 19: Comparing GARCH Family Members

For 12 November 2012

Now that we have a substantial family of GARCH models, how should we choose between them? The plan is to first consider some structural features, especially the connection to our old bête noire --- stationarity. There is also a Wold representation for GARCH models, but it's needs a bit more linear algebra than we may be ready to send.

One useful way to compare the many animals in the Garch Zoo is by looking at a plot called the "news impact curve." Given two models we first find appropriate values for the parameters of the models, say by fitting both to the same data. When then fix those coefficients and consider the the conditional variance as a function of the innovation epsilon_ t.

This function tells us how the two models will differ in the importance that they attach to a given shock. This measure is not perfect, since it speaks to just the impact of one shock. Still, it seems to be informative, and it is easy to implement (see e.g. S-Code Ex.)

The picture we get will give some intuition about which models "care" most about a negative shock versus a positive shock. Still, the pictures are not perfect, since it is not always easy to say which parameters values are "comparable" when one looks at radically different models. One way to make progress is to fit both models to the same data. Unfortunately, this begs another question; namely, the question of model specification.

Next, we consider non-normal drivers of the GARCH model. This is an important issue that makes the GARCH model much better than it would be otherwise. Still, the trick is old, going back to Bollerslev (1986).

Finally, we dig into a paper of Hansen and Lund which compares some 330 GARCH models. This is a heroic effort which we will be delighted to cover only from the summaries. Still, there is room to note a fundamental philosophical point. To compare one needs a criterion. How is one to choose among the potential criteria? My favorite is fitness for use. This is by far the most sensible criterion, but it does put a lot of questions to the modeler --- most of which do not have comfortable

Caveat

I tend to "sell" the take-away from Hansen and Lund to be that "you don't need to look much further than GARCH(1,1), or perhaps EGARCH(1,1)."

I do believe this, but it is a little sophistic to argue this just from exercises like that done by Hansen and Lund. The problem is the criteria for judging the models. Hansen and Lund use a bundle of them, but a eight inadequate measures are not all that much better than one.

Also, the idea of ranking a zillion pretty similar models and then looking at the ranks --- well, that is clever, but it is also a bit sophistic. We'll also look at the paper of Wilhamsesson for a bit more perspective.

Alternative Features of Merit

There is another principle that I like. You could call it simulated verisimilitude. You fit the model, then simulate data from the model, then do EDA on your simulated series and your original data. If the EDA (and other logical) comparisons are not pretty close, then you have good reason to be unsatisfied with your model.

It is amazing to me how seldom this method is used by model builders in operations research, scheduling, logistics, transportation, etc. Those guys very often use models that have very little relation to the stylized facts of their business. In financial time series, we do at least have this part of the drill down pretty clearly.

Last Homework! This homework provides experience using a GARCH model to engage something that is of bottom line interest --- the relationship of risk and reward. As it is presented, it is reasonably straightforward. Nevertheless,t if you have time, you can use it to do a little exploring for your final project. It also provides a reminder of the very on-going importance of basic regression and EDA studies.

Sidebar: Roll of Subjective Judgment in Risk Models

The NY Times article "In Modeling Risk, The Human Factor was Left out" adds a bit to our discussion of VaR models, especially those models that ignore "known but unobserved risks" such as the historical "peso problem" or the more recent "agency problems" of CDOs.

Sidebar: Leverage and Lifetime Strategies

It has occurred to many people --- especially my colleague Dean Foster and his co-authors --- that historically one would have done well by being leveraged. We also saw this when we discussed Kelly betting, even thought we cast doubt on the wisdom of playing "full Kelly". The naive expected return maximization argument that irked Samuelson, turns out to have a more sophisticated "diversification over life argument." This has been developed in a recent paper which is worth a quick look.

Election Night Epiphany

For 7 November 2012

This was a "Moneyball" election that should be recorded in history (along with other features) as a FULL EMPLOYMENT ACT for statisticians.

Sure, it may have cost me 60-80K in taxes over 4 years, but I am not bummed at all. My former colleague Ben B. has been very, very good to me, Although he will leave shortly (to get paid!) I trust that life will not be too different with Ben's replacement by renewed President Obama.

We'll take a look at In-Trade Prices for the Presidential Race.

Day 18: The "Leverage Effect" and the GARCH ZOO

For 8 November 2010

The GARCH model takes a major step toward a realistic statistical view of the noise in asset return series. Still, it is not perfect. In particular, the plain vanilla GARCH model responds symmetrically to either a negative or a positive shock. Historically, it is the case that a large negative shock has a more substantial impact on subsequent volatility than does a positive shock. A plain vanilla GARCH model cannot capture this phenomenon.

Fisher Black (partner with Myron Scholes in the Black-Scholes formula) called this phenomenon of asymmetry the "leverage effect" and the name has stuck. Black gave an interpretation of this empirical phenomenon from the point of view of the firm's debt to equity ratio --- one traditional measure of leverage.

Since observed volatility is not well explained by debt to equity (except in certain extremes), the name "leverage effect" does not seem to be a good one. Nevertheless, the effect is real. When you take any of the models that test for a "leverage effect" you will be likely to find that it is significant.

Black's Leverage and Modigliani-Miller

Black's leverage story may seem to contradict the Modigliani-Miller Theorem. If it did, it would not particularly bother me. Still the problem is worth pondering. I'll argue the view that there is no contradiction because the Modigliani-Miller assertion is about value, and Black's leverage story is about volatility. Now volatility does effect value, but subtlety --- through volatility drag from our perspective, but surely not enough to make us regard the MMT and Fisher's leverage effect as contradictory.

Incidentally, the venerable Wikipedia has a remark on the MMT that I think is particularly wise: "Since the value of the theorem primarily lies in understanding the violation of the assumptions in practice, rather than the result itself, its application should be focused on understanding the implications that the relaxation of those assumptions bring."

We'll then look at the models that attempt to cope with the so-called leverage effect. Most of our attention will be given to Nelson's EGARCH model, or exponential GARCH model. This is the "next step" model that has rather reasonably stood the test of time. It is definitely useful by both academic and practitioners. It definitely has its uses, though it does not provide nearly as big an increment to our toolkit as GARCH itself.

After EGARCH there were many other models that attempted to deal with this or that stylistic fact that is not well modeled by GARCH. Naturally, one eventually faces a certain law of diminishing returns. Still, it pays to know about at least a few of these.

You can check out some relevant examples in S-Plus. It does indeed turn out that when you fit a model like EGARCH to the returns of an individual stock, you are very likely to get a significant value for the leverage parameter.

It's not easy to say what this really means to us in an investment context, but it is certainly worth thinking about.

Leverage Effect not a Leverage Effect

For year's I have argued that Black's interpretation of the "leverage effect" as a "leverage effect' didn't really make sense, and II figured that everybody knew this.

Turns out that there was still a paper to be written, so if you want (substantially) more than what comes with our Fermi calculations, you can look at an informative 2000 paper of Figelwski and Wang.

Sidebar: Risk and Reward

The big question is "Do you get compensated for taking incremental risks --- or is it the case that for any given asset incremental risk (as measured by "volatility") is an a priori bad thing?"

In the classical stocks versus bonds story, we see historically a very reassuring compensation for risk taking, but through time and within one asset class the story comes close to reversing itself. You'll get to explore this in HW9 which will be the last homework (though there are intermediate deliverables for your final project).

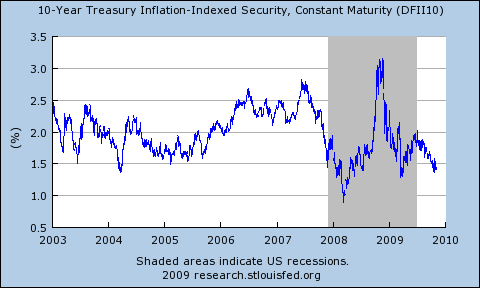

Sidebar: TIPS Yields in a Crisis

Krugman's blog story about this argues that the spike in TIP yields post Lehman's bankruptcy was due to liquidity. Keep in mind that vanilla treasuries yields were dropping during this time as part of the traditional flight to quality. I can't quite get that TIPS lack 'quality' --- but perhaps in a mad-rush-for-the-doors way they do.

Anyway, the next time that it looks like financial Armageddon, you might (1) first slam into Treasuries, (2) swap over to TIPS after about 5 months, then (3) after about 5 more months sell your TIPs and go long equities ---- first favoring the most volatile assets (emerging market, small cap growth, financials) then moving to large cap growth and energy. In the great recession of 2008 we saw that financials did have a nice up-tick as Armageddon was taken off the table, but then there was a still or fade as a more genuine recovery got under way. The amazing super winners were consumer discretionary.

History may not repeat itself, but at least this gives you a baseline to squirm around.

For an simpler "TIPS rule" how about this? It's hard to be disappointed if you buy TIPS with real yield above 3% (and you should be pretty happy with real yields above 2.5%). Alas, it may be quite sometime before we see TIPs with a 3% real yield.

Incidentally, here is a simple puzzle. For very short durations (say 3 months), there should be almost no difference between the total return on TIPS and the treasuries of the same duration. The real benefit of TIPs is that you can hold a long duration asset with no credit risk, no call risk, and a granted real return.

Sidebar: The Pollyanna Fit

This is a variation on a point made in the Granger article that we discussed in class. Take any old time series of returns and replace all of the 'big moves' with 'something more tame." The do you favorite fit and see if you get a wad of extra significance. Here are some things to ponder:

- Can this give you insight on the "way to bet' in normal times?

- Do the 'big move days" appear like a Poisson process, or do they have more clumping?

- What are good candidates for replacing the data on the 'big move days"? One candidate is the general mean.

- If you use a Pollyanna fit to organize your bets, what are your risks? The thesis is that you can 'break even' on the big move days --- which you give up on modeling. This can be true or false.

Sidebar: MERFX --- Interesting Theme, Bad Expense Ratio

"The fund normally invests at least 80% of assets in the equity securities of companies which are involved in publicly announced mergers, takeovers, tender offers, leveraged buyouts, spin-offs, liquidations and other corporate reorganizations."

This is perhaps not a bad idea if one is after a decent Sharpe ratio. You have less than market risk (only losing 3% or so in the annus horribilis 2008) and an expected return of perhaps 8% to 10%. You can also back test the theme with simple rules, and it looks like there is a little cheese here. Still, the good folks at the Merger Fund don't work for free, they snack on an expense ratio of 1.45%. If you like the idea, why not do some reverse engineering. It seems a terrible pity to waste 145 basis points.

The classic way to play this theme is to buy the company being acquired and sell short the company doing the buying. This stirs a lot of leverage into the pot, and when things are 'normal' there is useful risk-adjusted cheese in this game.

Day 17: ARCH and GARCH

For 5 November 2012

The ARIMA models underpin a large part of the theory of time series, but they have an Achilles heel when applied to financial time series --- the conditional variances of ARIMA models do not change as time changes.

For financial time series, this is in violent contradiction to reality.

One of the most fundamental stylistic facts of asset returns is that there is "volatility clumping" --- periods of high volatility tend to be followed by periods of high volatility, and periods of low volatility tend to be followed by to be followed by periods of low volatility.

The ARCH and GARCH models were introduced to remedy this situation, and they have led to models that are much more representative of financial reality. Our plan will be to develop these models as they evolved, first looking at why they are really needed. We'll also look at the tools in S-Plus for handling GARCH models, either in simulation or in fitting.

Finally, we'll discuss some original sources, notably a review article by Robert Engle called GARCH 101. The notation used in this piece is no longer the standard notation, and some bits are best taken with a grain of salt. In particular, given what we know now, Engle's discussion VaR is "optimistic" to say the very least. Still the piece is instructive.

Another paper we might discuss briefly is Engle's paper with Andrew Patton "What Good is a Volatility Model?" Ironically, this paper has the "tell" that I have mentioned in class, namely it uses the Dow (OMG!) as its illustrative price series. I don't know what motivated this choice, and I find it a little less serious than I would have hoped.

A positive feature of the paper is that it gives a brief list of "stylized facts," a very important notion to which we will start paying more systematic attention.

Sidebar: "Will We See a January Effect This Year?"

Mark Hubert had a piece on this in 2008 and it may be worth thinking about for this year. His thesis was that the January Effect (i.e. bigger small cap returns than big cap returns from 12/15 to 1/15) is more pronounce in years where the market has been strong going into December. Naturally, post the Jacobsen and Zhang paper that we looked at last time, we know that there is at least some revisionist thought about the January Effect. Still, it is interesting, and if you only believe in plain vanilla beta, you would expect that this year we will see small caps out-perform large caps if the market continues to do well in 12/15 to 1/15.

Sidebar: TIPS Spread and Temporary "Insanity" of November 2008

"TIPS yields indicate investors are betting consumer prices will fall. Five-year TIPS yielded 0.31 percentage points more than Treasuries of similar maturity this week." --- Bloomberg 11/1/2008

Yes, this was a very strange situation and it did not last. There were a few months of YoY deflation, but the TIPs real yield did normalize. The structure of TIPs is such that newly minted TIPs are protected against both deflation and inflation. Typically, seasoned TIPS have had some inflation change to their "par value" and this can be clawed back if there is deflation --- but the claw back does cannot send the "par value" below the original issue price.

Historical norms suggest that 2 to 2.5 percent real return may be a natural level, so the current negative (or near negative) real yield is quite storage.

Sidebar: TrimTabs, Money Flows, and "Bottoms"

"When public companies are net buyers while individuals are heavy net sellers, the market is making a bottom": This is an interesting assertion of the TrimTabs Liquidity Theory. The irksome part of this little observation is that "making a bottom" can take a lot of time and money. From the publication of this piece, the bottom did not present itself for five more very long months --- and almost as much value destruction as had been booked from November 2007 (the previous top) to November 2008 (the date of the quote).

Incidentally, there it is interesting to look at Brazil during the period of the crash and recovery November 2007 through June 2009. The US market made a pretty sharp turn in March 2009 which we now view a the "bottom" but Brazil and other EMs started the up-turn a solid month earlier. Yes, markets are absurdly coupled, but still --- it looks like there may have been a useful signal there. Participants in the Brazilian market decided earlier than others that the world was not coming to an end.

Sidebar: Mean Reversion vs Momentum

Essentially every quantitative strategy depends on a view that is either "trend following" --- that is a momentum strategy , or "trend reversal" --- that is mean reversion strategy.

Between the two, there is always a finely pitched battle. It seems to me that the momentum story has more reported successes. Still, there are situations where the mean reversion case can be made. One of these was mentioned in the Granger article covered last time.

As a variation on the strategy reviewed there, take any set of say 100 stocks. Now on each day, buy the 3 that are off the most at the close, and hold these stocks for 10 days. Now, compare this strategy to the comparable market buy-and-hold strategy. How do you do? Here, by the way, you might take your transaction cost to be 5 basis points on each leg of the trade. This is realistic if your trades are small enough to avoid market impact cost but large enough so that you are essentially paying one bid-ask spread for a round trip.

The biggest potential "bug" in such a study is that your real-world "buy on close" price may have some slippage from the "print" close that you find in the historical data.

Day 16: Switching Regressions, Non-Linearity, Forecastability, and Cost-Benefits of Subjectivity --- and, oh, Tells!

For 31 Oct 2012

Because of Hurricane Sandy, we have to compress Days 15 and Days 16. I'll keep the "blog" in its usual reverse order but I'll do the material of Day 15 first. NO HOMEWORK IS DUE ON MONDAY NOVEMBER 5. We'll have just two more homeworks (No. 8 and No. 9). The rest of our time will be focused on project design, generation of project ideas, etc. The lack of HW this week will I hope encourage you to do some reading and start contemplating your final projects. I'll spell out some of that plan today, but I'll be more systematic later.

Still, our main goal is to review a classic discussion paper by Clive Grainger, "Forecasting Stock Market Prices: Lessons for Forecasters."

Grainger shared the 2003 Nobel Prize in economics and his contributions find few equals in the world of econometrics. Granger's old paper has benefits for us even though at this point the it is rather dated. One benefit is that it can be 95% understood at the level of Stat 434. Second, and more persuasively, it suggests some potentially useful ideas that even now have not fully explored.

As a caveat, Grainger's introductory comments on martingales and the EMH is way off the mark. For example, if asset prices were martingales as the introduction considers, then only risk-seeking gamblers would invest, and this is not the case.

This part of t he paper can be fixed with just a small correction. For example, one can use a model I mentioned earlier. Specifically, the ratio of an asset price to the market price may be more feasibly viewed as a supermartingale which you recall is a "bad" game. This makes the assertion logical. Unfortunately, it still remains untestable because even the remote possibility of a very bad outcome can upset the whole apple cart.

There are many smaller problems, such as the uncomfortable casualness with which dividends are discussed. One wonder a bit if Grange go the arithmetic right.

At other places in the paper, we have to be concerned about data quality, or logical stationarity, or data relevance. For example, one of the papers that Granger discusses uses market returns back to 1896. For me, this is just too far past the "use by date".

Similarly, at one place Granger looks at transaction costs of 0.5% or even 1%. Nowadays, this is a silly level of transaction costs for the assets in question --- except in the remotely relevant situation of market impact costs. In more common (but still special) situations, you are even paid to trade; that is, you make money trading, even if you just break even on the trades. This sounds weird, but I will explain. It is a little bit like being a shill in a poker game. Sidebar: The Wiki piece on shills looks only at the negative side. There really is a positive side too!

Nevertheless, if anyone is looking for advice about how to have better luck forecasting asset returns, Grainger's piece is a very sensible place to begin... for more, look at the more recent papers that cite this classic.

Finally, we can see more clearly now that Grainger did not set up his analysis in a way that was most likely to lead to success. He could have taken a hit from the CAPM: The market is a great sea on which individual stocks bobble up and down with the waves.

One has much more chance for predictability if one removes the effect of the overall market as much as possible. The easy way to do this is to always look at spreads. If now you take each of the ideas in Grainger paper (such as splitting regressions) and you apply that idea to the spreads --- well, now you have a chance for cheese.

"Sell in May" and 317 Years of Monthly Returns

There is a recent paper that cobbles together a UK 317 year monthly return series and then takes aim some engaging some of the favorite Calendar Anomalies.

In particular they note: "Winter returns – November through April – are consistently higher than (negative) summer returns, indicating predictably negative risk premia. A Sell-in-May trading strategy beats the market more than 80% of the time over 5 year horizons."

They also note: "Studying the Sell-in-May effect is interesting, as it is quickly evolving as one of the strongest anomalies. It challenges traditional economic theory, as it suggests predictably negative excess returns."

On page 8, you will find a time series regression for the detection of month effect. They quite pleasantly let the intercept be the estimated January return and then have dummy variables for the remaining eleven months so they can capture the difference in the return for those months.

It is not easy to tell if it is news you can use, but it is worth reading --- either for fun or for a professional discussion of time series regressions and a very interesting data set.

Caveat: If if did not like Grainger using data that went back to the 1890's how do I feel about data that goes back to the 1690's? Well, I mainly feel amused. This is history and it may teach us something about animal spirits that could continue to influence price behavior. Besides, it was wonderful to lean that Christmas began in 1837.

More Caveats: Read the very interesting footnote on page 11 about the speculative fever that overcame the UK markets in 1824 and the crash of 1826.

Note: Citation Searches

When you find an article that you like (or even one you don't like), you can find more recent articles that follow up on it by doing a citation search. This is typically a much more efficient way to find relevant research than just by looking up a topic. In particular, if you look up a topic that is too broad --- like forecasting --- almost no one can thread his way through the forest. Citation searches are a very powerful research trick.

Note: S-Plus Tools For Rolling Regressions

We may also discuss the tools that are available in S-Plus for dealing with dynamic regression. Rolling regressions and weighted rolling regressions are a staple in many of the Stat 434 final projects, but at this stage you can probably learn everything that you might need about these tools just by working through the code box example.

Note: Risk Free Rates

For a CAPM style modeling exercise, one needs "risk free rate." Exactly which rate one might choose is open to debate, but 30 day treasury yields are usually appropriate. When you put any rate into the regression you will naturally have to make sure you are comparing apples and apples --- i.e. daily stock returns and daily risk free returns. To convert treasury yields to daily yields, you can use the conventional 360 day year. For data resources you have several options.

Sidebar: J. P. Morgan's Measure of Hedge Fund Long/Short Exposure

One of the metrics that is regularly reported in some of the sell-side research from J. P. Morgan uses a rolling CAPM type estimate to get an estimate of the net-long exposure of hedge funds. What they do is estimate a rolling beta for the aggregate returns of a collection of long short equity hedge funds. Since these are supposed to be "hedged" we expect a beta less than one. If the fund are net short we would even expect a negative beta. What one gets in the end is a sequence of beta's that do provide a measure of net exposure. Since this is supposed to be the "smart money" higher values of the index --- so more net long exposure --- would be a bullish indicator for the market.

They use a 21-day Rolling regression on daily hedge fund returns reported by HFR's index HFRX. The market surrogate is the MSCI World Index.

Sidebar: Russian Stock Market Closes for Week

This happens every year. Now here is the puzzle. The Russian ADRs like VIP will still trade in the US (and elsewhere). There will also be Russian and BRIC ETFs. This is a new circumstance, and it would not surprise me if a thoughtful consideration of a few years of data might turn up some ex ante cheese, even if statistical methods will not tell the whole tale.

Sidebar: Returns to Thinly Traded Stocks

A Forbes article (10/28/2010) notes that

"Ibbotson has studied stock returns back to 1972 and says thinly traded stocks beat highly liquid ones of equal market values in all four quartiles ranked by size. The spread ranged from 12 percentage points a year between the least and most actively traded microcaps to 2.8 points between the least and most popular megacaps."

This is an amusing thesis. It is no really a time series thesis, but it does suggest that you no reason to choose A over B then you might choose the more thinly traded of the two. Here thinness would be measured by something like the averaged daily volume divided by the shares outstanding.

Sidebar: Regarding CAPM and Other Puzzles --- What Changes a Mind?

“Children do eventually renounce their faith in Santa Claus; once popular political leaders do fall into disfavor…Even scientists sometimes change their views….No one, certainly not the authors, would argue that new evidence or attacks on old evidence can never produce change. Our contention has simply been that generally there will be less change than would be demanded by logical or normative standards or that changes will occur more slowly than would result from an unbiased view of the accumulated evidence.” ---Nisbett and Ross (1980), quoted by Hong and Stein (2003).

Incidentally, this quote is consistent with the notion of confirmation bias which asserts that a person holding a view is more likely to be attentive to evidence that supports his view than evidence that does not. Confirmation bias is a feature of human psychology that has been demonstrated in a great variety of experiments.

Sidebar: Uses of Subjective Information

In science and engineering there is a tradition of working hard to minimize subjective content of models and analyses --- but even there one has to admit that many design choices are based on subjective information. There is a phenomenon in economics called "physics envy" and this is one of sources of pressure for analysts to minimize subjective input into financial and economic models. The downsize is that this leads to more and more weight being place on historical observations. As we know from the discussion of the Peso Problem, such back-looking empirical estimates may ignore some serious economic facts.

This brings us to the thorny issue of subjective input in to models like those that are used in VaR calculations. It is clear to me that subjective input would have provided at least some improvement on the VaR models that have blown up over the last year. If one does advocate subjective input, it's a good idea to give a periodic review of the cognitive biases which can be as real --- and as dangerous --- as the "path-focused objective myopia" which one might hope to ameliorate with the inclusion of at least some explicit subjective inputs.

Sidebar: The Old Bellwether Idea --- It's now Now the Apple Tell

For the longest time people would look to GM (LOL!) and later IBM as "bellwether" indicators of the market. That is, these were viewed as leading indicators of the whole market. More recently Apple, Google, RIMM are the new "bellwethers" --- at least for the tech sector.

Is this baloney, or is it cheese? BTW, "cheese" is a 434 term of art that stands for "excess returns." This friendly term has not been used much this year, perhaps as an apology for past year abuses.

Day 15: Time Series Regression and Applications to CAPM

The plan mostly focuses on the natural extension of ordinary least squares regression (OLS) to financial time series. Still, there are new topics, such as the likelihood ratio test and the AIC criterion. We'll particularly look at AIC, AIC weights, and the way to use these to combine forecasts.

We'll look at the nuances of the model and its associated tests. We may also cover a MSFT/CAPM example that is bundled with Finmetrics, but you can just as well look at this by yourself.

One of the most famous models that fits into this context is the 1992 Fama-French Three Factor model. This is the model which for many (but not all) signaled the "death of the CAPM." Parallel Mark Twain's line, the rumors of the death of CAPM may have been greatly exaggerated. Still, the true believers are starting to face a sea of troubles that are almost as tough as the ones face by those who preferred had a hard time with heliocentrism, but comparably sure experiments are much harder to come by.

The Wikipedia article on Fama describes the three factor model, and it also has useful links, including one to the original FF92 paper and a good humored one to a Dartmouth humor magazine.

If you do look at the original lFF92 article you will see that there is a fair amount of technology there which we have not engaged. Still, with the tools we do have you can tell very similar stories. The basic tale is pretty robust. It's time to list it as one of our "stylistic facts."

Maximum Likelihood and the ML Ratio Test

Basically all the test that you have seen in all of the statistics courses that you have taken are obtained by on general method, and they are all what is called a maximum likelihood ratio test.

The computations behind these tests are a basic part of other statistics courses, but we still to well to review a bit of this theory. In particular, it gives us the chance to nail down the very fundamental notion of the likelihood. This is critical for maximum likelihood estimation, for the likelihood ratio test, and for other cool stuff like the AIC, which comes up next.

Akaike's Information Criterion and Model Averaging

The Akaike Information Criterion (or AIC) is perhaps the most widely applied criterion for model selection.

For my own account, I am not a huge fan of AIC. The main problem is that in many cases one assumes at least as much going in as one hopes to infer coming out. In pure model selection there may be some net gain in most cases, but, since there can be loss in some cases, it is not clear that one wins over all.

Still, the AIC is out there, and it mostly seems to point in the right direction. It's probably worth consideration in most contexts, provided that one does not get too carried away.

Model Averaging: A Practical Alternative to Model Selection

If you are interested in using your model as a forecast, you may be able to side-step the problem of model selection. Rather than simply chose model A or model B to make your forecasts, you can instead consider an appropriate average of the forecasts given by the two (or more models).

Foster's Trick For Model Averaging

There are many rules one can pose for averaging the forecasts given by a set of models. You could just take the simple average, or you could take a weighted average where the more accurate model is given a larger weight. A still more principled idea that I learned from Dean Foster is to use regression. Here one takes the forecasts of the models and regresses the observed returns against these forecasts. One can then use the regression coefficients as "weights" for the combined model. Here we use the quoted because the weights can be negative and need not add up to one, so this method is not strictly an averaging method.

Naturally this idea must be combined with good sense. The forecasts given by your original models are quite likely to be highly correlated, so this regression problem can be ill-conditioned. My advice would be to consider this as a exploratory tool. There is no reason at all why you cannot stir in your own judgment.

The "Best" Criterion --- Fitness for Use

The model that is best is the one that "works" best for you. Ironically, this criterion is not often discussed. I have written a bit about this, and eventually I will write more. The whole notion of a model is one that deserves a richer --- and more philosophical --- view that is common in statistics courses.

Sidebar: "120/20 Good Buddy"

Among the strategies that now have the public ear are the 120-20 strategies ---- leverage up 20% on the long side and off-set this leverage by going short for an amount of 20%.

Naturally, such a strategy would be nuts --- unless you could pick winners for at least part of your up-position and pick mostly under-performers for your short position. As a retail investor, you would also face an 8% margin cost headwind on the 20% that you are leveraged and the headwind of any dividends to be paid on the downside.

Thus, for an individual investor replication of a 120-20 strategy is a non-starter.

As an institutional investor, your long position will cost LIBOR and a bit and your short position will pay LIBOR minus a bit, so for professionals the whole game becomes modestly feasible.

Thus, professionals have the opportunity to let you in on this game --- for a modest fee, of course. This is a good trick all by itself, but the 120/20 pitch has a ready listening. You can look at some of the recent pitches.

My own view is that these retail issues are not good deals, but I am open to arguments on the question. If you are looking for a final project, you might want to consider a project that plays off of these funds.

Sidebar: Unconditional Variance of the AR(2) Model

Alex Goldstein has kindly written up a derivation of the unconditional variance of the AR(2) model. His trick is to use a variation on the Yule-Walker equations, but not the Yule-Walker equations themselves. The calculation is actually not-to-bad, and it is certainly easier than the Wold decomposition approach that I suggested. Still, even this method shows that one does not want to look for a formula for the unconditional variance for the AR(3) model.

Sidebar: CRB and Dollar Index

Here the picture looks compelling (CRB up, Dollar Index down) but we know that it is easy to ge hypnotized by price charts. Nevertheless, there is some logic to this if commodities are indeed "priced" according to some international basket of currencies. What needs thinking through is that the dominant asset in the CRB is oil and at least in principle it is priced in dollars. Gold would be another story.

Sidebar: VXX and Going Long or Short Volatility

VXX is an ETN that is supposed to track a perpetual 30 day VIX futures contract, which is something that exists only in theory. Naturally there are fees, expenses, and the possibility of incompetent tracking. Still, if you don't have a futures account, or can't stand the nose bleed of trading futures, then this still gives you a way to 'express your view' about implied volatility. The contract is relatively new, but it is sponsored by Barclays --- one of the ETF/ETN good guys --- so it may turn out to be a useful trading asset.

As we saw in class, from the crazy days of the crisis it would have been a naturally and very profitable to short the VXX. Still, that is a "ex-post" observations. It is easy to find things that would have been wonderful do to between March 2009 and the present.

Here there are further factors involved. In general, the long term holder of any commodity ETF faces some headwinds due to the term structure of futures contracts. Moreover, a well informed contact tells me that this traditional headwind is particularly vicious for the VXX contract. So much so that he asymptotic value of the VXX may well turn out to be zero. Unfortunately,t the only guarantee is that if we have a serious macro event it will be very painful to be short VXX. On the UPS scare of 10/29/2010 could have been much worse.

Sidebar: Distressed Debt --- One Thousand Words

HW 6: Comment Regarding the Cauchy Distribution

The Cauchy distribution is a special case of the t-distribution. It comes up naturally in many places, and it's principal claim to fame is that it looks like the normal when you graph it --- but the graph is deceiving since the Cauchy has very fat tails. The Wiki page on the Cauchy tells you more --- perhaps too much.

More HW6 Q and A:

- EDA means "Exploratory Data Analysis"

- Yes, a t-distribution with one degree of freedom is the same as a Cauchy distribution.

- Does location and scale disturb the interpretation of a qqplot? That is a puzzle for you to contemplate.

- RYTNX is a mutual fund, not a stock. The returns are in WRDS. This series is longer than the 2x ETF alternatives.

- Remember Always: Google is an extension of your MIND. It will answer many questions --- including these.

- Logic of ADF test. In the simpler DF test you are testing only the hypothesis that the AR(1) coefficient phi_1 is equal to one. In the ADF test, you are still just testing this hypothesis but you allow for the possibility that the model is more complicated than the plain vanilla AR(1). Under the null hypothesis --- where you are looking at something that is random walk like --- the model is a RW to which has been added a stationary (or I(0) ) process. For details, look at the model specification in ZW.

- Small point. Any series with drift is a non-stationary series --- specifically having a drift implies that the means are not constant as they must be for a stationary series. We we do an ADF test that "allows for trend", we are really saying ---- ok, remove any trend then tell me, is the hypothesis that I am now looking at a RW wildly improbable?

From Bad Idea T-shirts... but not unfriendly to the Twain quote...

SPECIAL Note: HW 7 Due Wednesday Oct 31

Because of SANDY there will be no class on Monday. Just stay snug in your rooms and ponder the universe. You can hand in your discoveries on Wednesday.

Day 14: VaR --- The Sad Story

For 24 October 2012

The first (and main) part of the plan today is to look at the most widely used tool for expressing risk exposures:VaR, --- or Value at Risk.

As I said even before the 2007 course blog: "There is much wrong with the way VaR is used and calculated --- even in the most enlightened firms. Some implementations are close to (1) a hoax or (2) at least naively self-delusional. "

Still, VAR used almost universally. Moreover, the vast majority of implementers are sincere in their belief they have done their best.

The people I hold responsible for the destruction caused by VAR are those who said, "Everyone else has good Value at Risk measures. Either you guys come up with a system that works, or I'll get someone who can." In such an organizational situation, you are guaranteed to get bogus analyses --- all of which will agree very comfortably agree with all the other delusional models. This is sad, but very human --- the mechanism of social proof is as universal as any phenomenon one can imagine.

Again, humbly quoting myself from the 2007 blog, "If one could simply bet against run-of-the-mill VaR estimates, one would not need to look for other investments. This would be ... a veritable paradise of Black Swans, vastly more lucrative than those (too rare) Black Swans that stingy options traders occasionally provide."

Why, Oh Why, Is this So?

There are two virtually insurmountable problems with VaR as it is calculated in most firms. These are the "Peso Problem" and the "everything is correlated at the extremes problem. " There is also a less overtly dangerous but still unavoidable problem I call "Tukey's Biased Estimate of Variance."

The "Peso Problem" is a standard part of economic lore ---- but it is steadfastly ignored by essentially ALL VaR models. The point is that "observed risk" (say as measured by historical return standard deviation) and real risk (say as set by the smartest book makers) are often wildly different. There are indeed "infinite Sharpe ratio" investments that are (at most) only mediocre bets.

The "correlation problem" has also been widely understood for a long time. It was one of the forces that led to the demise of LTCM. It was one of the forces in Niederhoffer's first blow up after the Asian Crisis of 1994. Still, my favorite example actually goes back to the great flood of 1927, and I'll tell that story in class.

Despite the long history , the" correlation problem" is ignored in 99.9% of VaR models.

Finally, how about Tukey's Estimate? I'll elaborate in class, but --- it's ignored. Why? Because it would force everyone to bring down their leverage. Well, since the fall of 2008, we have the strong sense that bringing down the leverage early is sometimes the right thing to do. The VIX, the LIBOR-OIS spread, and other indicators told us what to do, but VaR was the last to speak --- and it was too late.

John Tukey understood all of this, even before the ideas came into play in a financial context.

With a barrel-chested sotto voce rumble, he would say, "The variability that you have seen is always an under estimate of the true variability." In our context, where volatility and variability are cognates, Tukey is on one side, and the world's VaR models are on the other.

My money is on Tukey.

Still, many firms are getting better at VaR, and we just need to have evolution play its role. Though many individuals in many firms will kick and scream, the big firms with the best VaR models (and other risk controls) will be survivors. As the "subprime" story played itself out, we found that many firms had VaR estimates that were pure garbage. It seems inevitable that some measure like VaR will always be with us --- and it seems that sometime again in the future it will greatly fail us.

Peso, Correlation, and Tukey are too much headwind for anything.

Extreme Value Distributions --- Use at Extreme Risk

On the more technical side, we'll look at extreme value theory, which is one of the tools that theoreticians always seem to want to trot out when there is a discussion of big market moves. The mathematics of the extreme value distributions is interesting, but for several reasons extreme value theory doesn't deal with the reality of extreme market moves.

We'll discuss the Gumbel (or Fisher-Tippet) distribution in class. It comes out of a beautiful limit theorem, and it is the leading example of what are know as extreme value distributions. Sadly --- and in stark contrast to the Central Limit Theorems --- there is a major disconnect with any level of honest practice.

You will see from a homework problem that the convergence is excruciatingly slow even in the ideal case of normally distributed random variables. There are people who have advocated the use of this distribution in financial practice. It has even been used as part of the Tokyo building code. These applications are bogus, bogus, bogus.

Still, extreme value distributions are worth learning about. There probably are special contexts where they are applicable, and they have a undeniable charm. Also, they are part of the common language, and any time "extreme" events are discussed, they are likely to be drawn into the conversation. When this happens, be prepared to be skeptical.

As a sidebar, this also give us a chance to discuss the some core ideas of simulation, including the rejection method and the inverse probability transform method.

More on Risk-Adjusted Returns

At some point in life every one should read what Bill Sharpe has to say about his famous ratio.. For an excellent article on Sharpe ratio ESTIMATION I recommend Lo's article for AlphaSymplex.

Sidebar: "Is RSP a Stinker?"

Just as a side note, you might want to think about a project that plays RSP versus MDY. These are assets with different designs, but which are very highly correlated. RSP has a bigger expense ratio, so it may be that the portfolio of long MDY short RSP can have a sweet Sharpe ratio --- small mu, but microscopic sigma.

Sidebar: Sales of Safes Spike in Crisis Week 10/22/2008

The CEO of Wal-Mart gets to see secrets of human behavior that most can never see. In a CNBC interview on 10/22/2008 Lee Scott observed that his stores saw a "run on safes" during the weeks of the October 2008 financial crisis.

HW 6 Note

If you are having trouble finding RYTNX returns, note that it is a mutual fund. Also, it may be that you'll find it in the "quarterly updates" rather than in the "annual up-dates.(Thanks to Himish Lad for this tip!)